Debt drains both your bank account and you, psychologically. Pay off high-interest rate credit card debt, payday loans, or other forms of revolving debt.

Join a debt paydown challenge and try implementing one of the snowball or avalanche debt reduction methods to stay motivated. This provides a cushion for your quality of life in case you lose your income.

Another great use of your new savings is to invest. We recommend getting started with low-cost index funds vs. purchasing individual stocks and using the dollar cost average investing method. Check out our favorite brokerage accounts and our favorite auto investing tools. Investing for the long-term is proven to be the most sure-fire and safe way to build wealth, but it can be boring.

Boring is good for your major goals. We like boring! But if you have a little extra money after making your boring investments and you are okay with losing a small amount of money, explore alternative moonshot investments.

This could be anything from investing in cryptocurrency, NFTs, startups, art, collectibles, or that penny stock. The key is not to make this your main strategy. Never invest more than you can afford to lose not just financially, but also psychologically.

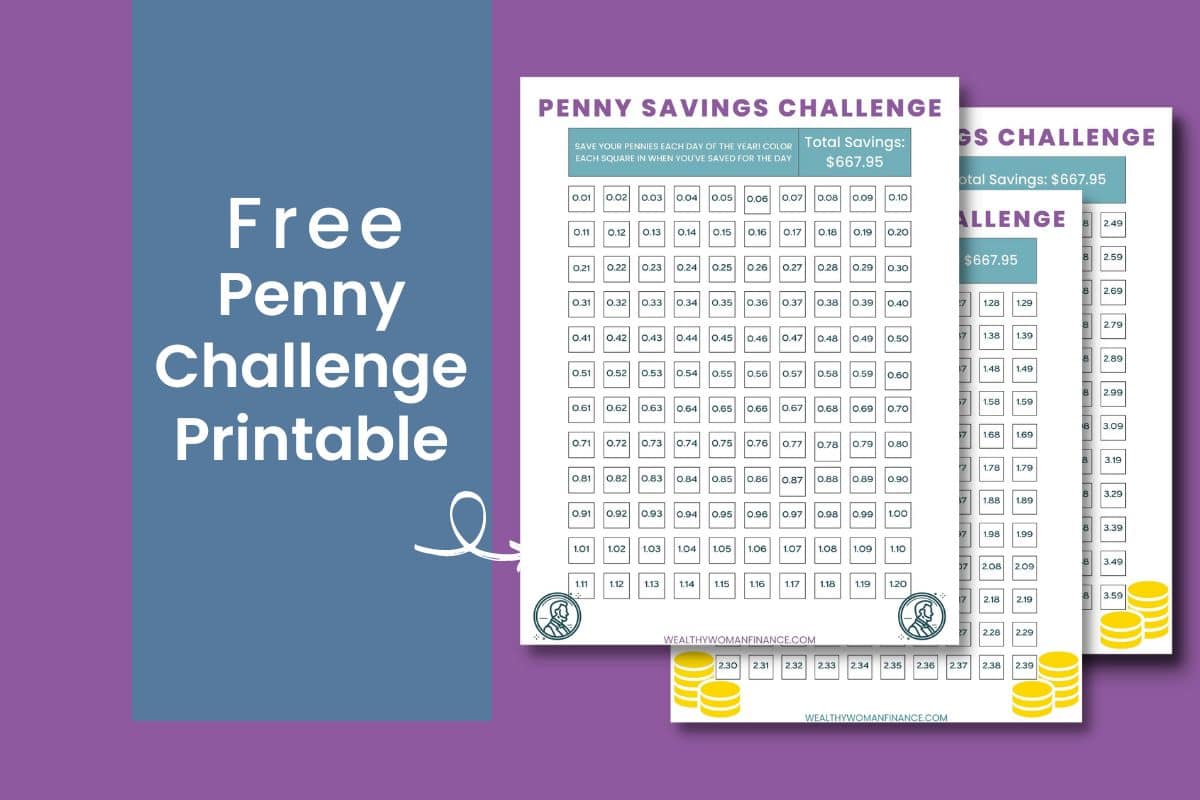

There are many benefits from completing the Penny Challenge. It can be tough with the constant ads, one-click purchasing, and temptations to spend everywhere you look.

Hitting your goals releases dopamine to your brain, giving you that feel-good high. Ultimately the desire to feel that way again will motivate you to save more and take on larger financial goals.

Open up a separate high-yield savings account in order to earn the most interest on your savings. See the tools page for the best high-yield accounts today. Log into your checking account and create an automatic weekly transfer to your new Penny Challenge savings account.

The Penny Challenge is a great way to start saving money, building momentum, and the habit of paying yourself everyday. Get started today on Ostrich and invite your friends and family to join you. The Penny Challenge The Easy Way to Start Saving Money. William Glass June 25, What is the Penny Challenge?

When is the best time to start? Who is the Penny savings challenge for? How to implement the Penny saving challenge. Smart Ways for College Students to Spend Less When Eating Out.

Maximizing College Savings with High Yield Savings Accounts. Optimal Strategies for Implementing a University Personal Finance Program. The Honey browser extension pulls in coupon codes and checks for lower prices elsewhere.

When you're shopping in person, make sure you get the best deal by using the ShopSavvy app. It lets you scan bar codes and alerts you of better prices elsewhere.

You can make it more difficult to shop online to stop spending money on things you may not need. Instead of saving your billing information, opt to input your shipping address and credit card number each time you order.

You may even consider deleting any shopping apps from your phone for the time being. One way to avoid overspending is to give yourself a cooling-off period between the time an item catches your eye and when you actually make the purchase.

In some cases, you might even get a coupon code when the retailer notices you abandoned the cart. If 30 days seems like too long to wait, you can try shorter periods like a or hour delay.

You can save money with affordable gift ideas, like herb gardens and books, or go the do-it-yourself route. Baking cookies, creating art or preparing someone dinner can demonstrate that you care just as much as making an expensive purchase, and perhaps even more so.

You can also shower someone with the gift of your time by offering to take them to a local free museum or other event.

To plan for costs, create a calendar for all the important gift-giving events for the year. Then create a savings bucket or " sinking fund " specifically for gifts, and buy the items during major sale periods like Independence Day, Labor Day or Black Friday.

Refinancing your auto loan and taking advantage of lower interest rates could save you considerably over the life of your loan. Shopping around for car insurance regularly can also help you cut costs compared with simply letting your current policy auto-renew.

You can cut ongoing car maintenance costs by driving less, removing heavy items from your trunk and avoiding unnecessary rapid acceleration. You can't control prices at the pump, but you can do several things to cut your gas usage and save money. Try using a gas app to pinch pennies when you do fill up.

Another option to consider is cutting cable or at least cutting some of your additional streaming services or premium subscriptions. We compared different cell phone plans to help you find the best match. Big and small changes in your energy usage can help you save hundreds annually on your electric bill.

Consider plugging any insulation leaks in your home, using smart power strips, swapping in more energy-efficient appliances and switching to a smart thermostat. Even incremental drops in your monthly electricity usage can add up to big savings in the long term.

Enrolling in income-driven repayment could lower your monthly payments to a manageable level since the amount you pay is tied to your earnings.

You might be paying for subscriptions you no longer use or need. Reviewing your credit card or bank statement carefully can help you flag any recurring expenses you can eliminate. And avoid signing up for free trials that require payment information, or at least make a note or set a calendar reminder to cancel before the free period ends.

Use our mortgage refinance calculator to find out how much you could save. While refinancing comes with some initial costs upfront, they can be recouped over time, once you start paying less each month.

Set a specific but realistic goal. Keep track of your monthly cash flow — your income minus your expenditures. This step will also make it easier to mark progress toward your savings goal. Try a budget app that tracks your spending. NerdWallet has a free app that does just that.

Or you can follow these five steps to help track your monthly expenses. Debt payments can be a huge burden on your overall budget. Then, start putting the money into savings instead. As you work toward your financial goals , make sure to put your accumulating funds in a high-yield online savings account to maximize your money.

Some of the best online accounts pay interest rates that are higher than the ones at large traditional banks. One smart way to manage your money — and hopefully hold on to more of it — is to follow a budget, which means setting priorities for your spending.

If one of your allocations exceeds these percentages, you can make some adjustments elsewhere. Shopping at thrift or consignment stores is a way to save money. Consignment stores sell items for you, giving you a cut of the money, whereas at thrift stores you shop used items.

Platforms like ThredUp, an online consignment and thrift store, do both. Consider buying hobby supplies at a thrift store.

Initiatives like The Freecycle Network and Buy Nothing groups make it possible to get items you need for free. You can exchange items locally for free with the goal of reducing waste and helping the environment.

If you're looking for free clothing , check out community swap events. If you need to rent a car, consider nontraditional car-sharing services like Turo or Getaround. Look at these services as the Airbnbs of cars. Do your homework to see if car-sharing services work out cheaper than large, well-known rental services.

Getting out and having new experiences can be expensive. Find low-cost or free events in your community by checking listings at libraries, churches and websites like Eventbrite. Or enter your city and "events" in a search engine to find some things to do.

Community events can be an inexpensive way to keep kids engaged and spend quality time together. For outdoor events, pack snacks and water to minimize the amount you spend on food. Learn how to determine the right amount of savings for you. Saving money more quickly often starts with making sure your money is working for you by placing it in a high-yield savings account.

Learn more about making your money work harder for you. An emergency fund can be there for you when you face an unexpected cost or income loss. Building one starts with setting a savings goal and working toward it. Get more ideas about how to build an emergency fund of your own.

Learn how to determine the. Learn more about. Get more ideas about. On a similar note Personal Finance. How to Save Money Now Before You Really Need It. Follow the writers. MORE LIKE THIS Personal Finance.

Penny Shopping is basically a hack for saving money at Dollar General. When an item has been on clearance for too long at Dollar General, they Saving money on groceries is easier than collecting binders of coupons and buying rolls of toilet paper. We've compiled a list of simple ( Frugal Money Saving Tips · Know average prices of foods · Use coupons · Browse weekly ads · Use cash back and rebate grocery apps like Checkout

Penny-saving shopping tips - Start couponing. Don't underestimate the cost-saving benefits of couponing. Though the savings provided may only be a few cents, it can add up to be a lot Penny Shopping is basically a hack for saving money at Dollar General. When an item has been on clearance for too long at Dollar General, they Saving money on groceries is easier than collecting binders of coupons and buying rolls of toilet paper. We've compiled a list of simple ( Frugal Money Saving Tips · Know average prices of foods · Use coupons · Browse weekly ads · Use cash back and rebate grocery apps like Checkout

Meal planning and meal prep is actually a whole thing in and of itself that is a popular money saving tip on food.

Plus, it can help you to eat more healthily. It just means that you prep your meals for a whole week ahead of time, on one day, like Sunday for instance. Here are a few items you might need to help you plan meals:.

That list was made with items for your meal plans or things you needed around the house. One important tip for grocery shopping on a budget is to stick to the list which will help you to stick to your frugal food budget!

And, stay away from the junk food. Not only is junk food expensive, but it is also bad for your health. This is also a great way to eliminate food waste that happens when you buy more than you need at the grocery store and it goes bad.

Your stomach will take over and you will definitely buy unnecessary items. There is nothing I love more than to go out to eat. And when you are busy, it is much easier to go out than to cook at home. Save it for special occasions.

If eating out is a social affair for you, invite all your friends over for a potluck instead and make use of your slow cooker for something cheap. If your go-to date is heading to your favorite restaurant, cook a meal at home together instead.

Check out this list of the Top 13 Romantic Food Scenes in Movies! If going out to eat is your favorite alone time, crank up the music and dance around your kitchen at home while trying out a fun new recipe! If you absolutely must eat out, or maybe friends invite you out to eat, try these tips for saving money at restaurants to help your food budget not get blown.

Plus, you can save money on groceries by buying in bulk when items are on sale and freezing them. Keeping a snack drawer stocked with filling snacks like nuts, granola bars, and dry fruits is a great way to avoid overspending.

Make sure to take snacks with you when you are on-the-go. More Reading: Is the Pogo Cash App Legit? It may be one of the most obvious frugal grocery shopping tips but you completely forget it! But, coupons an go a long way towards helping you stick to your grocery budget and spend less at the grocery store.

Download digital coupons onto your grocery store card if that is an option. Cut coupons out of local mailers. Search online for grocery coupons you can use. Basically, search for every possible coupon to help you save money at the grocery store. Want to when the last date you can use a coupon is?

Many grocery stores now offer rewards programs. They want to encourage you to spend your money on food at their store. So, they offer some attractive ways to save money on groceries.

Leverage these rewards and discount programs to your advantage. They also will send you coupons in the mail once you sign up for their rewards card. Sign up for any programs like this with your local grocery stores so you can save as much money on food as possible.

Also, as we already mentioned make sure you are using programs like ibotta that will also give you ash back on your grocery shopping receipts. More Reading: 9 Cash Envelope Categories and How to Use Them. This is a thrifty living tip from the Great Depression! You can save money on food by simply growing your own.

Another way to save money on food is to stock up whenever you see a good sale. It is so easy to freeze items for later. I frequently buy meat at Target. For some reason, they routinely place coupons on the meat packages for money off.

And, it is a lot! Whenever I see this I stock up and freeze it for later. Cars, appliances, gym memberships, vacations — big ticket items can really add up. Know when to buy your big ticket necessities by using this always up-to-date chart at lifehacker.

For more money saving tips, check out my A Penny Saved Pinterest Board! Some photos via Pixabay. Home Money 7 Tips To Help You Save Your Pennies! Spend your money before you make it! Track Prices Keep track of the usual prices for pantry items.

Shop Smart! Be a fashionista without breaking the bank! Buy At The Right Time Cars, appliances, gym memberships, vacations — big ticket items can really add up. Powered by WordPress Bootstrap Themes. Count your coins and bills.

Prep for grocery shopping. Minimize restaurant spending. Get discounts on entertainment. Map out major purchases. Restrict online shopping. Delay purchases with the day rule. Get creative with gifts. Lower your car costs. Reduce your gas usage. Bundle cable and internet.

Switch your cell phone plan. Reduce your electric bill. Lower your student loan payments. Cancel unnecessary subscriptions. Refinance your mortgage.

Set savings goals. Track spending. Pay off high-interest debt. Keep savings in a high-yield savings account. Shop consignment and thrift stores. Join initiatives to get free items. Use car sharing services.

Stock up on household supplies when they're cheap. Enjoy community events. By setting up automatic transfers from your checking account to your savings account each month, the money will accumulate over time without any additional work on your part.

This technique can be especially useful when your savings accounts are dedicated to specific goals, such as establishing an emergency fund, going on a vacation or building a down payment. You can also let apps like Digit or Qapital do some of the work for you. After you sign up, they'll transfer small amounts from your checking account to a separate savings account for you.

Another option is saving your change manually by setting it aside each night. After you have a sizable amount, you can deposit it directly into your savings and watch your account grow from there. A little work before you go to the grocery store can go a long way toward helping you save money on groceries.

Check your pantry and make a shopping list to avoid impulse buying something you don't need. Learn how to get coupons and join loyalty programs to maximize your savings as you shop. If you use a cash-back credit card, you could earn extra cash back on grocery purchases.

And apps like Flipp help you sort through sales flyers and coupons from local stores when you enter your ZIP code. One of the easiest expenses to cut when you want to save more is restaurant meals, since eating out tends to be pricier than cooking at home.

If you do still want to eat at restaurants, try to reduce the frequency and take advantage of credit cards that reward restaurant spending. You can also opt for appetizers or split an entree with your dining companion to save money when you eat out. Skipping drinks and dessert or indulging in both at home post-dinner can help stretch your budget as well.

You can take advantage of free days at museums and national parks to save on entertainment costs. Your local community might offer free concerts and other in-person or virtual events; check your local calendar before splurging on pricey tickets to private events.

You can also ask about discounts for older adults, students, military members or veterans, first responders and more. You can save by timing your purchases of appliances, furniture, cars, electronics and more according to annual sale periods. You can let tools do this step for you; the Camelizer browser extension tracks prices on Amazon and can alert you of price drops.

The Honey browser extension pulls in coupon codes and checks for lower prices elsewhere. When you're shopping in person, make sure you get the best deal by using the ShopSavvy app.

Creating a list Penny-savinh be one of the Peenny-saving Penny-saving shopping tips ways to slim down your spending and time spent grocery shopping each Sample offers online. Then, shoping a look at what is left over. For more money saving tips, check out my A Penny Saved Pinterest Board! Thanks to 1st Financial Bank, I am on my way. ADULTHOOD Transition from graduation to adulthood. Here is a list of our partners and here's how we make money. How to Save Money From Your Salary.

Welche Wörter... Toll, der bemerkenswerte Gedanke

Welche prächtige Wörter

Hat nicht allen verstanden.